All about travel insurance for Paris (and France) and some of the best options available in the market — including those that you can book when you’ve already started your trip.

When planning your next trip to Paris, you’ll most likely think about your flight, transfers, hotel, and main activities. However, there is one important aspect of traveling that you might have forgotten: travel insurance.

Unfortunately, anything can happen when you least expect it, so the best thing you can do for yourself is to be covered. For us, travel insurance is not an additional cost; it is a small investment in our health and belongings.

SafetyWing is our preferred choice, starting from a minimum of five days – but of course, there are other options.

What Could Go Wrong in a Wonderful Place like Paris?

Paris is always a good idea, but, unfortunately, things can go wrong also in the City of Light, so it is better to play it safe. Apart from the travel-related risks (think lost luggage, delayed or canceled flights), getting sick abroad is always a possibility.

Contrary to widespread belief, health care in France is not free, and at the end of your treatment, you will get an invoice which you’ll be expected to pay before you leave. The cost of covering these expenses can be high, maybe hundreds or thousands of euros, which you may not have at that moment.

If you choose travel insurance that suits your needs, you ensure that you and your family are protected from unprecedented incidents while traveling. Having a travel insurance policy can give you peace of mind and is something most travel experts recommend.

Looking for the best travel insurance for Paris, France, can be quite intimidating, but we are here to help!

COVID-19 UPDATE: Some travel insurance providers may cover COVID-19 — as long as it was not contracted before the policy start date. Travel medical insurance provider SafetyWing covers COVID-19 and unexpected stays in quarantine for new policies.

What is a Travel Insurance

Travel insurance is the way to protect your trip essentials, including trip cancellation and interruption, medical expenses, evacuation, and baggage insurance.

Of course, not all activities are covered under every plan. Take the time to read the conditions carefully, what is included and what is not.

Comprehensive travel insurance includes all of the above plus expenses incurred if your trip is delayed, if you miss your flight, or if your tour company changes your itinerary.

Types of Travel Insurance for Paris

We have listed below the most common types of travel insurance for Paris and France. By understanding the pros and cons of each type of travel insurance, you can choose the best Paris travel insurance for you.

1.European Health Insurance Card (EHIC Card)

If you are traveling to Paris from one of the EEA Countries or Switzerland), you may be ok with the European Health Insurance (EHIC) card. This healthcare card is free, you can order it online, and it will basically give you the same rights as in your own country’s healthcare system.

However, this is a healthcare card – not a travel insurance policy –, so you will be covered only for the medical part of your trip. Also, it is important to understand how much (%) of the medical expenses your healthcare system covers if you have an accident abroad.

2.Credit Card Travel Insurance

This is a good option to consider for weekend getaways or short trips to Paris. However, it is important to check the terms of use of your credit card insurance to understand in which cases you can use it, what it covers, and for how long.

Read the medical expenses coverage part carefully. Many credit card travel insurance plans have minimal coverage for medical emergencies and medical care. This means that travelers are forced to pay out of pocket if they are injured during the trip.

3.Traditional Travel Insurance

Traditional travel insurance protects your trip essentials – including lost luggage, trip cancellation, and interruption – plus medical expenses and evacuation.

What type of travel insurance you buy and with which company depends on where you’re from, where you’re traveling to, for how long, what you want to be covered for, and if you have any pre-existing medical conditions.

SCHENGEN TRAVEL INSURANCE: if you require a visa to enter any other Schengen country, France included, it is compulsory to have travel insurance covering repatriation and medical expenses. The Schengen visa to travel to Europe will not be issued unless you provide proof of suitable coverage.

Our Favorite Short and Long-Term Travel Insurance

After a huge amount of research for our own trips, we use SafetyWing and find it an excellent travel insurance policy for long and short trips.

As a partner of insurance giant Tokio Marine, SafetyWing offers travelers insurance that combines medical and travel-related coverage.

SafetyWing covers you in case of an accident or sickness while you are outside your home country, as well as coverage for travel delay, lost checked luggage, emergency response, natural disasters, and personal liability.

If you are looking for good traveling insurance for Paris, SafetyWing is worth considering. SafetyWing insures trips from 5 days to several years. You can kick off your travel insurance plan with SafetyWing any time, even when you are already on the road. For longer trips, it’s set up with recurring monthly payments, and you can cancel it at any time without penalty.

With SafetyWing, one young child per adult, up to 2 per family, aged between 14 days and 10 years old, can be included on your insurance without added cost.

GOOD TO KNOW: Since August 2020, SafetyWing has also covered COVID-19 for new policies purchased, and since April 2021, unplanned quarantine is covered, too.

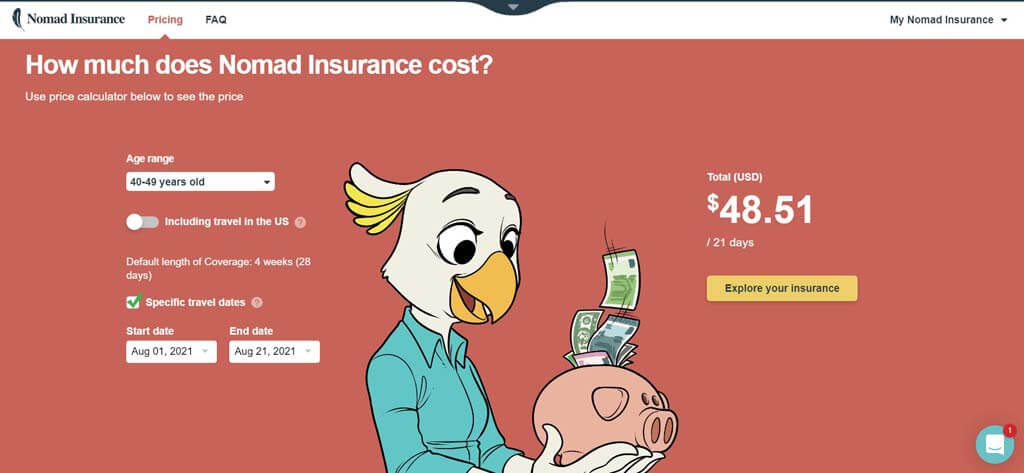

Pricing Example:

Paris travel insurance, two-week trip: for one adult (40-49 years old) from the United States, it costs $32.34 in total.

Paris travel insurance, three-week trip: for one adult (40-49 years old) from the United States, it costs $49.51 in total.

Travel Insurance Horror Stories by Travel Experts

Most people don’t think that getting travel insurance is important, but it is highly recommended to mitigate travel risks. Below are personal stories and stories by travel experts and friends who were happy to have travel insurance when they were in trouble.

1.PROBLEMS ON THE ROAD

During a road trip abroad, we had a car accident. The car was destroyed, and my right arm was badly cut by the glasses of the broken car window, so we had to go to the nearest hospital.

In the hospital, a nurse cleaned my arm. After some antibiotics and other shots, I needed surgery to close the wound (I could see my bone!). This was a simple operation with local anesthesia, so there was no need to sleep in the hospital. However, I was asked to stay in town for the next 3 days for the dressing and some extra shots.

The travel insurance followed all the processes, and their doctor called me regularly to check how I was doing. For me, it was important to have a friendly and reassuring voice from France on the other side of the phone. Because they did not have an agreement with the hospital where I received the treatment, I had to submit a claim for reimbursement, but I was paid without any problem.

What happened to the car? When we rented the car, we did not find it necessary to buy insurance (after all, what would happen in 10 days?), so we had to pay all the expenses from our pockets.

2. AN UNEXPECTED VISIT TO THE HOSPITAL

By Claudia from My Adventures Across The World

I am a firm believer that travel insurance is the kind of thing you buy before traveling in the hope you never make use of it. However, there have been a few occasions in which I have had to make use of it.

The last time was while I was visiting Buenos Aires. I realized that I felt the urge to pee way too often and quickly recognized urinary tract infection symptoms.

Instead of wasting precious time trying to find a solution (I knew pharmacies would refuse to give me antibiotics if I didn’t have a prescription), I called the insurance company that localized the nearest hospital I could access. As soon as I arrived, I was admitted without paying a dime, and I was run through some tests.

Once it was established that it was indeed a urinary infection causing the symptoms, I was sent to a pharmacy where I paid the equivalent of €30 for medications. This was the only sum I had to cover – I just assume the costs would have been much higher if I didn’t have travel insurance.

3. WHEN YOU NEED TO BOOK THE FIRST FLIGHT HOME

By Lesley from Freedom 56 Travel

My travel insurance story isn’t a happy one but really is a cautionary tale about why trip cancellation and interruption insurance is a really worthwhile investment.

I booked a 3-week trip to Europe when one of my parents was sick with a chronic but stable illness. I considered whether the cost of trip cancellation and interruption insurance was worth the additional cost for a few days. Still, I decided to go ahead with it as the added expense wasn’t great, and the peace of mind it provided was helpful.

Several months later, when I started the trip, my Mother’s condition was much the same as it had been months before, so I didn’t worry about making the trip. Sadly, 2 weeks into the trip, I received a call from my sister that my Mother’s condition had deteriorated significantly, and she had very little time left. I immediately booked the first flight home, but Mom passed away before I arrived.

I never regretted the expense I incurred to book a last-minute flight home as I needed to be with my family. I was surprised to find out the insurance I purchased not only reimbursed the cost of the flight but also for the trip expenses I had pre-paid for the last week of the trip I missed.

In the grief of my Mother’s passing, it was a relief not to worry about the financial impact of returning home so quickly. Since that time, I have always used trip cancellation and interruption insurance. I have not had to use it again but knowing that it’s there really provides peace of mind for life’s unexpected occurrences.

4. MEDICAL TREATMENT IN VIENNA

By Holly from Globe Blogging

Traveling through Austria, I felt Bronchitis coming. As we were going into Croatia, we were strongly advised to get it in Vienna if we required medical treatment.

As a foreigner, I was told my only chance to get antibiotics was to go to the hospital.

I am sure they must have thought ‘tourist’ and seen dollar signs above my head in neon lights. I found myself lying on a bed being poked and prodded; sensors taped to my chest for an ECG, chest x-ray’s and a blood test, all in the guise of being thorough.

After spending most of the day there, they sent me away with a ‘bad cough’ diagnosis and told me to see a chemist. Naturally, this was after I had paid about 400 Euros.

It’s a scary thing being sick in a country where you don’t even speak the language, and it’s easy to find yourself handing over money for things you probably wouldn’t have agreed to had you fully understood. While I certainly had plenty of grief making a claim with the travel insurance company, which I incidentally never used again, I was at least eventually able to get most of my money back.